ESG is creating data nightmare for companies and investors alike

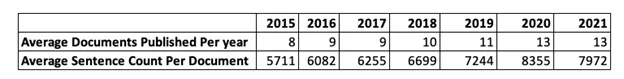

In 2015, FTSE 100 companies published an average of 8 corporate disclosure documents a year. Fast-forward to 2022, and the same companies are now publishing 13 documents a year!

There are now over 60 different document types being published, of which more than 50 are ESG-specific. The onus on companies to disclose ever more ESG information is creating a data nightmare, for themselves and their investors.

If ever there’s time to standardize ESG reporting, it’s now..

One of the core principles behind ESG reporting is transparency. As it stands, it appears that companies are doing their best to make their ESG disclosures available and accessible, but with no formal reporting standard, it’s a free-for-all.

There are no agreed boundaries on when, where, how and in what format to publish, let alone style vs content. The challenges this creates for anyone trying to evaluate ESG disclosures are that it’s onerous, manual, unpredictable and can feel like an endless task. This is leading investors to the reliance on the assessment of an ESG ratings agency, which creates its own issues of subjectivity and lack of transparency.

With the onus on business to get ESG ‘right’, it’s just as difficult for companies to know what to report on and how. ESG is a growing concept, but it remains immature, with a lot of conflicting views and different approaches being suggested every year. Creating a one-size-fits-all reporting guide is difficult, because of a range of factors such as company size, group structure, and the materiality of ESG issues being so different across sectors.

As a result, the disclosure of non-financial information by companies often feels like guess work. Some companies choose to include an ESG section in their Annual Report, some choose to prepare a separate Sustainability Report, or create an Integrated Report that contains financials and non-financials combined. In some cases, companies publish up to a dozen reports each year, often duplicating content across their documents.

There is also confusion around accessibility of documents once published. A great example is the CDP platform. Corporates are tasked with completing very detailed disclosures to the CDP and the content is uploaded to the CDP platform. From a corporate perspective they have done their job, but the CDP charges for access to this data. Information that’s assumed to be ‘published’ may not in reality be available to investment decision-makers.

Lost in Translation

When looking at the company’s own publishing platform, their websites, the work put into gathering and collating ESG disclosure can be “lost in translation” when the website isn’t built with the accessibility of content in mind.

It’s sometimes obvious that websites are built to prioritise design and flash over usability. The use of moving parts and appealing visuals often gets in the way of finding the actual content therein. By being really sophisticated and snazzy, the websites end up being confusing, inconsistent, sometimes, built like a maze of links and pages that refer and redirect to each other. The issues are often exacerbated with big consumer companies, with websites geared to attract customers as well as provide information. Those often end up being content black holes.

Another issue we come across is that published documents can disappear as soon as the company decides to remodel their website, change domain, or even just update the content. There are often clues about historical reports peppered around company websites, like press releases detailing that a company has published their first Integrated Report, only to offer the reader a broken link.

Out of Sight

We also commonly find a large amount of ESG information, such as privacy policies, published on company websites as a web page in html format, with no option to download the content. There is a danger in trusting that information, as web pages tend not to be dated, and they can easily be retroactively amended, or even deleted.

Companies tend only to surface their latest reports clearly on their websites. Of course, the latest Sustainability Report is the most relevant, and as such, is promoted by the company. This can make finding previous years difficult, or even impossible. There are cases where the new report replaces the previous one on the relevant webpage, even sometimes using the same url. In these cases, a user may assume that the previous report never existed, though that wouldn’t be accurate.

Anyone looking for information on a specific ESG issue faces additional hurdles given there isn’t a universal format that companies follow to disclose non-financial information. Someone interested in water metrics for example could hope to find the data in any number of reports. Has the company decided to include the information as part of their Annual Report? Or have they published a Sustainability Report which should include water related disclosures? Did they opt for the publication of a more specific Water Report? Released an annual ESG Data document?

The issue with a lack of consistent format also means there isn’t consistent titling across companies or even years. It’s sometimes difficult to know what document includes what information. Companies themselves often change how they report year on year, making tracking targets and performance difficult.

Neverending Story

The painful reality for anyone looking to make decisions on this information is that it feels impossible to know for certain that you have all the relevant information until you’d explored the entirety of the website, downloaded all the reports you’d found and then read them, or at least looked at their contents table, assuming they provided one.

For our team of expert collectors, it takes an average of 45 minutes per company to gather the relevant documents from a website. This is before they’ve been organised, usefully categorised and tagged so that the all important analysis on the content can start.

ESG v2.0

Having gone through the tough process of uncovering yet one data disclosure barrier after another to sound ESG reporting and research, we have harnessed expertise and technology to help dispel the nightmare of analysing ESG data to support the next generation of ESG, whatever that may look like.

Our platform provides users with a central repository of company ESG disclosures, categorised by report type and ESG issue. Using machine learning, each report is split into sentences and passed through AI models. Each sentence is scored against 15 issue-specific classifiers, so users can filter and surface relevant sentences out of the noise.

APPENDIX

Report Types – 60 distinct report types

| 20-F | Financial Statements | Privacy Policy |

| Annual report | Gender Pay Gap Report | Quarterly Results |

| Anti-Bribery and Corruption Policy | Governance Guidelines | Remuneration Policy |

| Audit and Risk Report | Governance Report | Remuneration Report |

| Climate Change Policy | Half-year Report | Social Impact Report |

| Climate Change Report | Health and Safety Policy | Sourcing/Supply Chain Policy |

| Code of Conduct | Human Rights Policy | Sourcing/Supply Chain Report |

| Code of Ethics | Human Rights Report | Stakeholder Report |

| Community Relations Policy | Integrated Report | Supplier Code of Conduct |

| Consumer Policy | Modern Slavery Statement | Sustainability Policy |

| Diversity Report | Other Environmental Document | Sustainability Report |

| Diversity Statement | Other Environmental Report | Sustainability Report Annex |

| Earnings Call | Other Financial Document | Sustainability Whitepaper |

| Ecology Policy | Other Governance Document | Tax Policy |

| Ecology Report | Other Governance Report | Tax Report |

| Employment Policy | Other Social Document | Waste Report |

| Environmental Policy | Other Social Report | Water Policy |

| Environmental Report | Other Sustainability Document | Water Report |

| ESG Data | Palm Oil Policy | Whitepaper (Environment) |

| ESG Report | Payments to Government Report | Wood and Pulp Policy |