Building a best practice ESG risk scoring system for private entities

The Brief

- Build a proprietary ESG risk scoring model for debt instruments for a portfolio of private entities.

- Combine ESG scores from a major ratings agency with alternative ESG data available for private entities not covered by the ratings agency.

- Support the build of an investment manager’s portfolio that beats the benchmark index’s ESG score while delivering competitive returns.

- Apply data science, AI and optimisation techniques to construct efficient portfolios.

- Deliver a market-leading solution, the first of its kind, fully auditable that attracts capital.

Approach to ESG risk

Every organisation is exposed to ESG risk by the nature and scale of their operations. Companies can mitigate this risk to avoid material risk. To assess if ESG risk has been mitigated sufficiently, there are two measurable risk components: Exposure and Management.

- ESG exposure is fundamentally a factor of the industry and region in which the company operates, and is based on a system of materiality.

- ESG management is company-specific and assessed through analysing a company’s risk awareness and mitigation, gathered primarily from evidence published in reports.

- These two components can be combined to reflect proportionality and produce a single ESG Risk Score that can be integrated into investment decision-making.

When data is lacking

When modelling company risk, ESG Exposure can to a reasonable degree be estimated by its industry average as it is a factor of operations, size and location. So, in cases where a company is not covered by a ratings agency, a score can be estimated as the best available technique. This approach is less reliable for assessing ESG Management, where companies diverge greatly in their approaches to addressing risk exposure.

Therefore, INSIG AI integrated alternative sources of ESG data to assess ESG Management. Our data compliments the ESG ratings agency score and enhances the industry average scores for companies not covered by the ratings agency.

Part 1: Building an ESG Exposure scoring model

Re-build an ESG Exposure scoring model from scratch in line with client’s risk methodology.

- Disaggregate, re-build and re-weight elements of the ESG ratings agency data into a new scoring model to give the manager greater control over risk factors at a more granular level.

- Forensic entity mapping between data providers which use different identifiers and formats, including MSCI, Capital IQ and S&P to improve data reliability.

- Implement ESG risk factors specific to debt instruments such as loan maturity in line with investment manager’s proprietary methodology.

Part 2: Developing a new ESG Management score

Create an innovative ESG Management scoring methodology based on company disclosures that is appropriate for entities not covered by the ESG ratings agency.

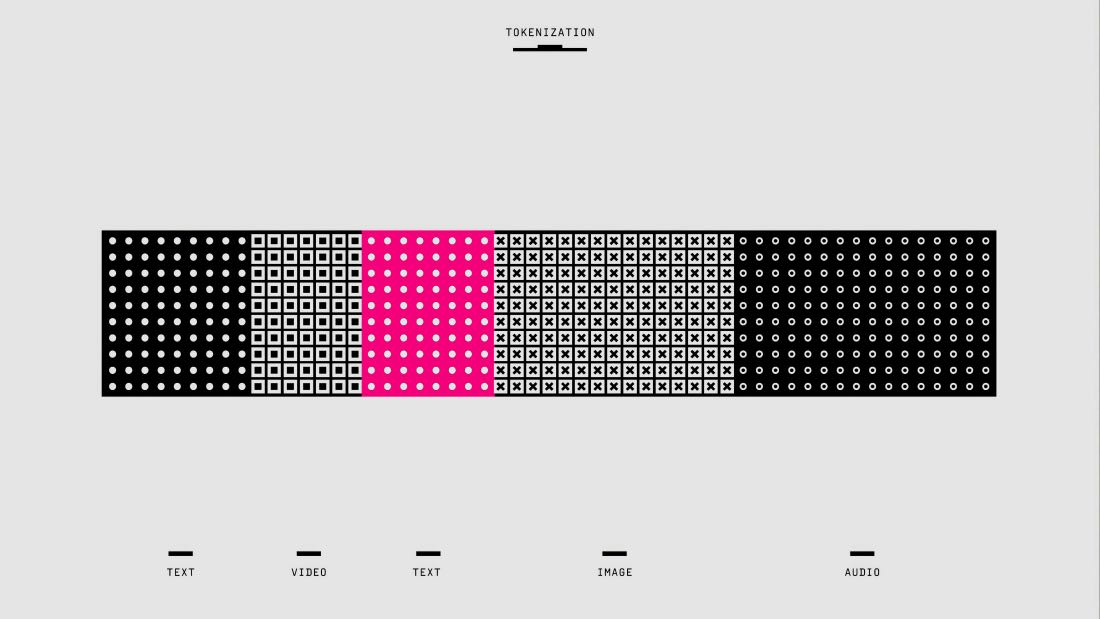

- Collect, tag and validate all Annual Reports and ESG/Sustainability Reports published on portfolio and benchmark fund companies’ websites since 2019.

- Convert all documents (mostly in .pdf format) to machine readable text. Split text into sentences, tag and store in a cloud-based database.

- Apply a ESG issue-specific Natural Language Processing (NLP) models over the text. NLP models are expert-trained to assess sentences for their relevance to ESG risk issues such as climate change, water, human rights and workforce.

- NLP models generate an ESG Disclosure metric based on volume of relevant sentences in the company’s disclosures.

- This ESG Disclosure metric is mapped and weighted with the ESG ratings agency data to produce the combined ESG Management score.

Part 3: Generating the final ESG Risk Score

Combine ESG Exposure and ESG Management into a final ESG Risk Score for the portfolio manager to assess in a web-based application.

- ESG Exposure and ESG Management scores combine into a single, company specific ESG Risk score.

- The scoring model is first developed with the investment manager, then coded into Python and finally delivered in a web-based application.

- Design a graphic front end that allows the investment manager to compare the portfolio against the benchmark and adjust parameters.

- The code, methodology and application are fully transparent and auditable and by third

- ESG Risk score is integrated with fundamental investment data in Insig AI’s machine-learning portfolio optimisation tool.

Outcomes

An innovative fund is launched which aims to build integrated ESG portfolios, establish the investment manager as a leader in ESG investment and successfully attract capital to sustainable methodologies. The model can be applied to the clients’ other debt and equity products.

Get in touch to find out if our approach could be applied to your credit or debt portfolio, and accelerate your ESG investing journey: info@insg.ai